Past Issues

- Winter 2023/2024 Vol 19 Issue 4

- Fall 2023 Vol 19 Issue 3

- Summer 2023 Vol 19 Issue 2

- Spring 2023 Vol 19 Issue 1

- Winter 2022/2023 Vol 18 Issue 4

- Fall 2022 Vol 18 Issue 3

- Summer 2022 Vol 18 Issue 2

- Spring 2022 Vol 18 Issue 1

- Winter 2021/2022 Vol 17 Issue 4

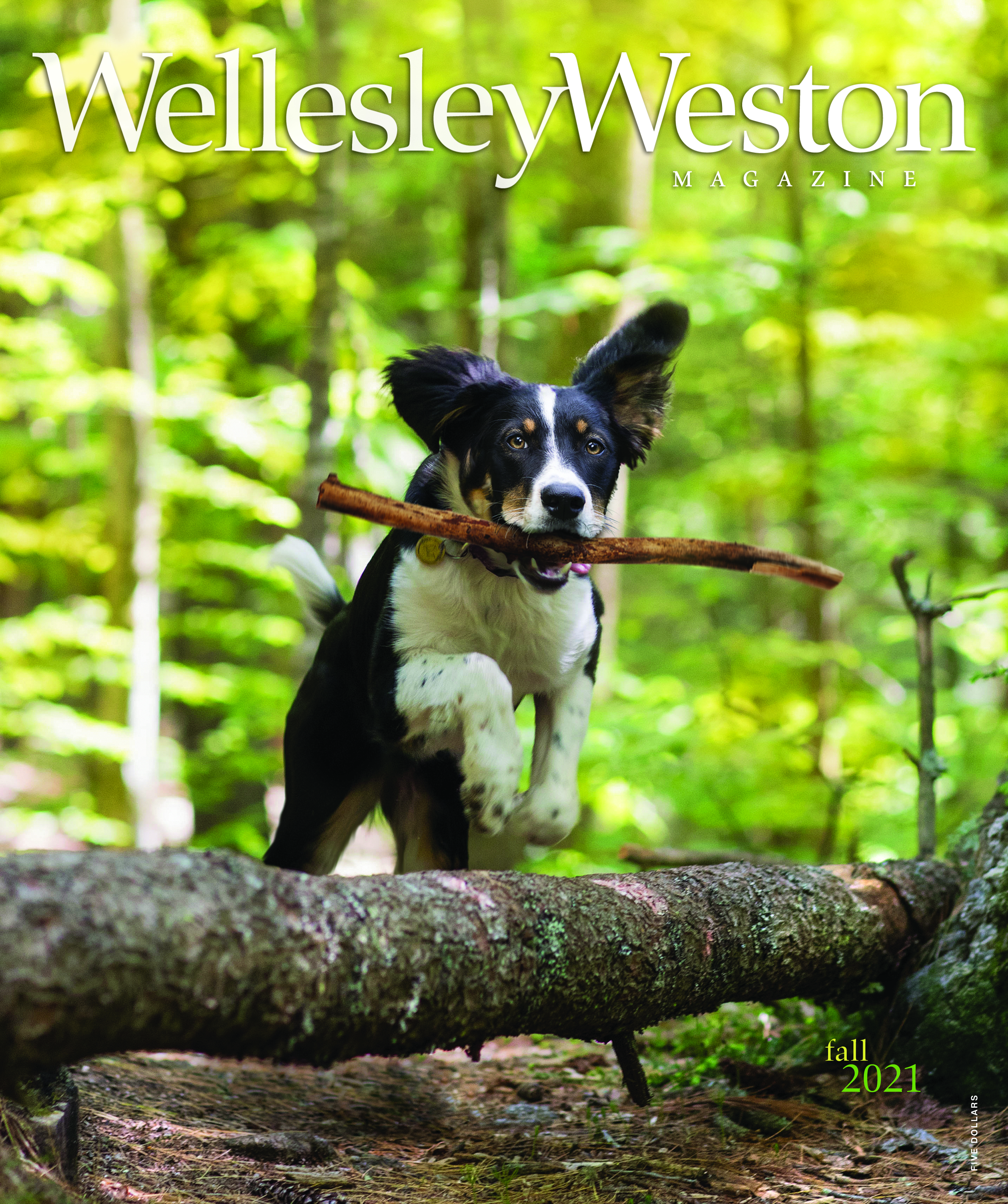

- Fall 2021Vol 17 Issue 3

- Summer 2021Vol 17 Issue 2

- Spring 2021Vol 17 Issue 1

- Winter 2020/2021Vol 16 Issue 4

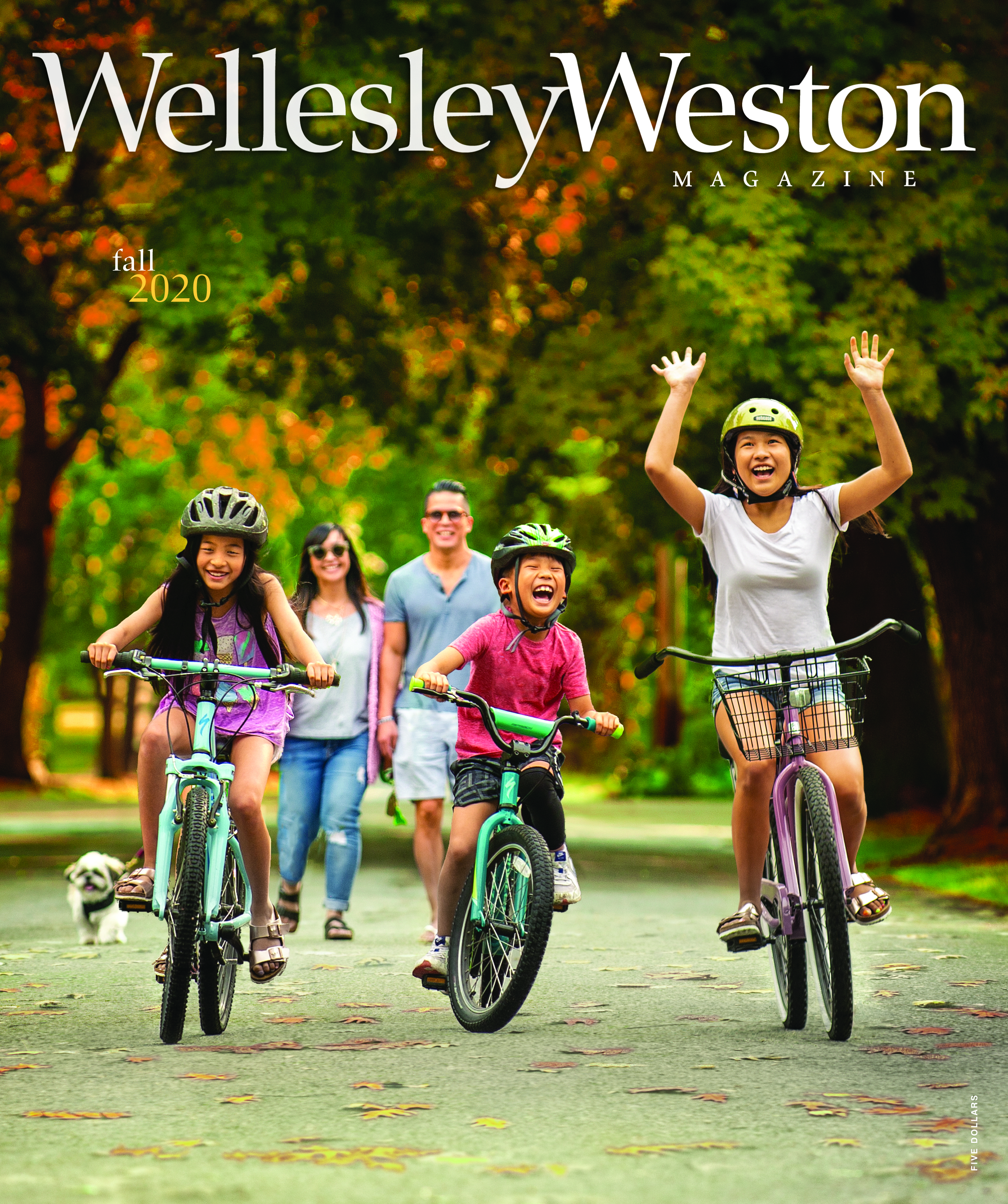

- Fall 2020Vol 16 Issue 3

- Summer 2020Vol 16 Issue 2

- Spring 2020Vol 16 Issue 1

- Winter 2019/2020Vol 15 Issue 4

- Fall 2019Vol 15 Issue 3

- Summer 2019Vol 15 Issue 2

- Spring 2019Vol 15 Issue 1

- Winter 2018/2019Vol 14 Issue 4

- Fall 2018Vol 14 Issue 3

- Summer 2018Vol 14 Issue 2

- Spring 2018Vol 14 Issue 1

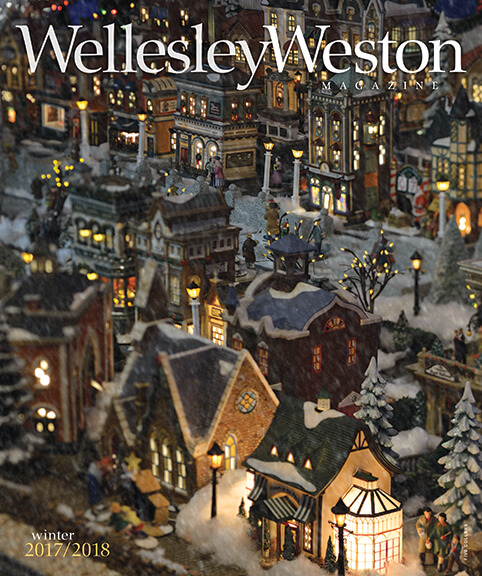

- Winter 2017/2018Vol 13 Issue 4

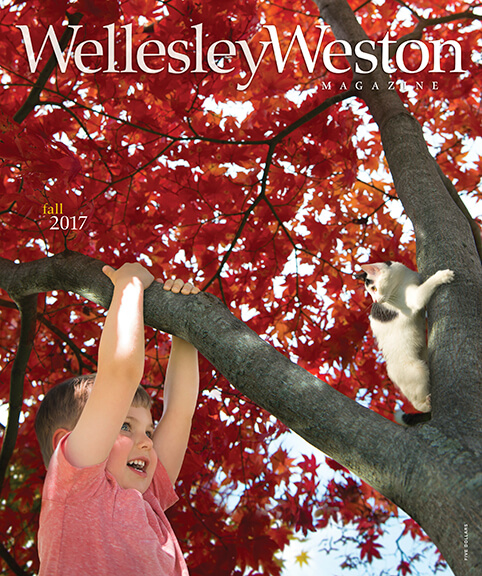

- Fall 2017Vol 13 Issue 3

- Summer 2017Vol 13 Issue 2

- Spring 2017Vol 13 Issue 1

- Winter 2016/2017Vol 12 Issue 4

- Fall 2016Vol 12 Issue 3

- Summer 2016Vol 12 Issue 2

- Spring 2016Vol 12 Issue 1

- Winter 2015/2016Vol 11 Issue 4

- Fall 2015Vol 11 Issue 3

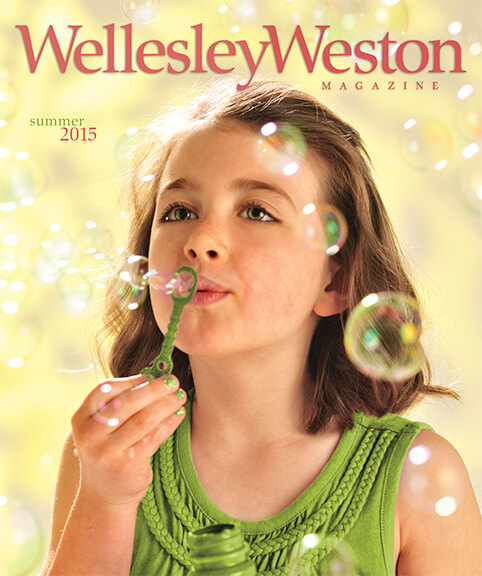

- Summer 2015Vol 11 Issue 2

- Spring 2015Vol 11 Issue 1

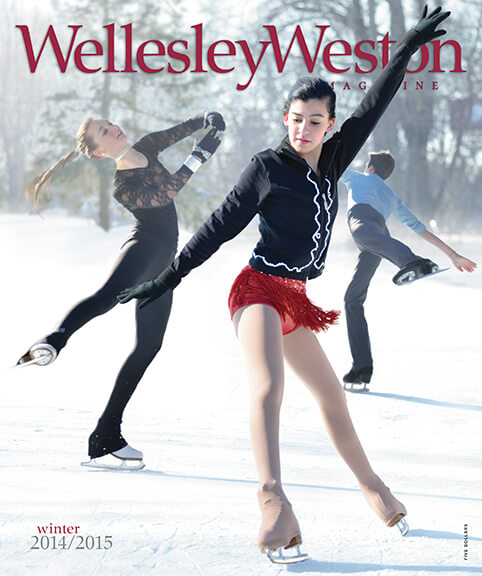

- Winter 2014/2015Vol 10 Issue 4

- Fall 2014Vol 10 Issue 3

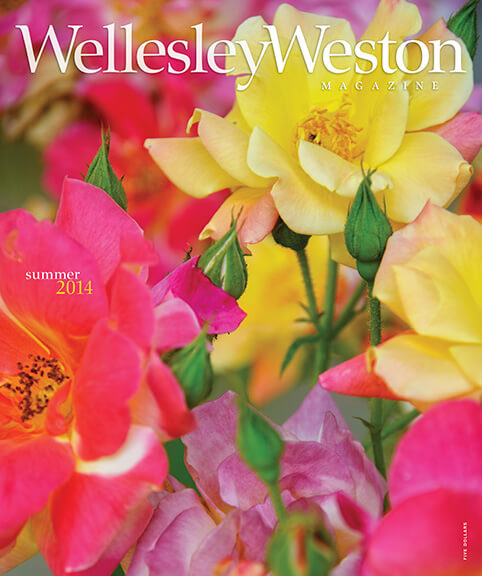

- Summer 2014Vol 10 Issue 2

- Spring 2014Vol 10 Issue 1

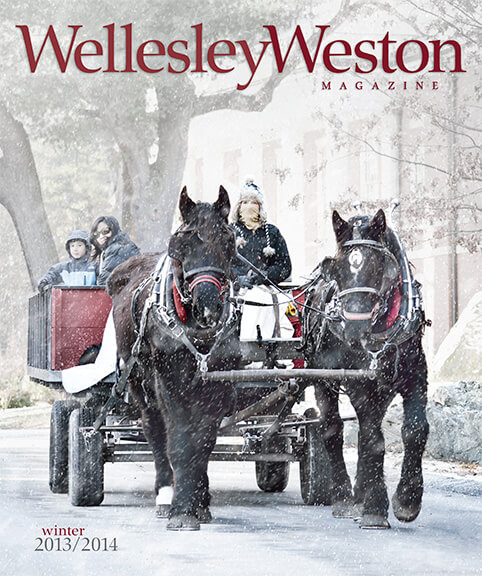

- Winter 2013/2014Vol 9 Issue 4

- Fall 2013Vol 9 Issue 3

- Summer 2013Vol 9 Issue 2

- Spring 2013Vol 9 Issue 1

Archive

- Winter 2012/2013Vol 8 Issue 4

- Fall 2012Vol 8 Issue 3

- Summer 2012Vol 8 Issue 2

- Spring 2012Vol 8 Issue 1

- Winter 2011/2012Vol 7 Issue 4

- Fall 2011Vol 7 Issue 3

- Summer 2011Vol 7 Issue 2

- Spring 2011Vol 7 Issue 1

- Winter 2010/2011Vol 6 Issue 4

- Fall 2010Vol 6 Issue 3

- Summer 2010Vol 6 Issue 2

- Spring 2010Vol 6 Issue 1

- Winter 2009/2010Vol 5 Issue 4

- Fall 2009Vol 5 Issue 3

- Summer 2009Vol 5 Issue 2

- Spring 2009Vol 5 Issue 1

- Winter 2008/2009Vol 4 Issue 4

- Fall 2008Vol 4 Issue 3

- Summer 2008Vol 4 Issue 2

- Spring 2008Vol 4 Issue 1

- Winter 2007/2008Vol 3 Issue 4

- Fall 2007Vol 3 Issue 3

- Summer 2007Vol 3 Issue 2

- Spring 2007Vol 3 Issue 1

- Winter 2006/2007Vol 2 Issue 4

- Fall 2006Vol 2 Issue 3

- Summer 2006Vol 2 Issue 2

- Spring 2006Vol 2 Issue 1

- Winter 2005/2006Vol 1 Issue 3

- Fall 2005Vol 1 Issue 2

- Summer 2005Vol 1 Issue 1

recent comments